About

For which purposes is payment by QR code suitable

- Charity

- Accept charitable contributions (donations) repeatedly using the same QR code. Place it anywhere. By scanning the code, people will be able to indicate the desired donation amount or donate the amount you suggest.

- Tipping

- Delivery couriers, taxi drivers, and hotel staff will be able to accept tips for services without cash. Create a QR code and place it where your customers will see it - on products, in taxis, at the hotel reception.

- Handmade

- Use a unique QR code for each of your unique fixed-price products, which customers can use to pay for this particular product repeatedly.

FAQ

- What forms of ownership are available to use the payment QR code?

- The QR payment code can be used by individual, self-employment persons, entrepreneurs, and companies of the following forms of ownership: limited liability company, private company, joint stock company, and others.

- Does a individual entrepreneur have to use a Cash Register when paying with a QR code?

-

The QR code contains information about the account details (IBAN) and the registration number of the individual entrepreneur's taxpayer registration card. Such data is decoded as an offer to make a payment (for payment through a bank account). According to the current legislation of Ukraine regulating payment transactions, a QR code is not a means of payment. At the same time, the use of a cash register or a payment transaction recorder does not depend on the form of payment transactions, but on the method of receiving funds by the individual entrepreneur (seller) as payment for goods or services.

Thus, in the case of the sale of goods, works, services, payment for which is made using a QR code, which contains the full bank details of the sole proprietor's account in the IBAN format, the individual entrepreneur is not obliged to use a cash register or a software cash register.

- Do I need a receipt when paying to IBAN?

- When paying with IBAN, a check (fiscalization) is not required. However, if you also accept cash for goods or cash for services, you need to register a cash register

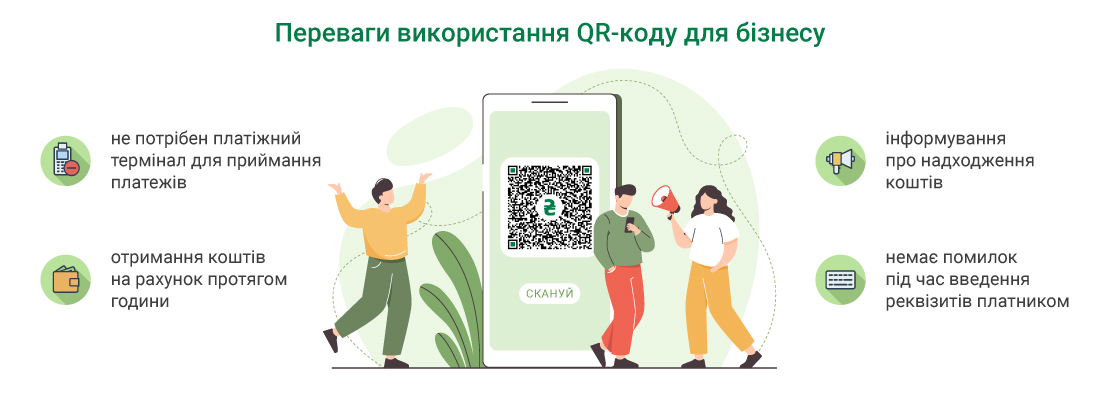

- Why is payment by QR code more profitable for the seller?

- Let's compare QR code payment with acquiring. Retail outlets are provided with payment terminals through which transactions are conducted. Businesses pay a commission for this service, which can be on average 1-5% depending on the type of acquiring (merchant or online acquiring). When paying with a QR code, the customer pays the commission at the rate of his bank for a cashless transfer from IBAN to IBAN. No special equipment is required for this payment method.

- How quickly are funds credited when paying by QR code?

- The money from customers is instantly transferred to the IBAN account indicated in the graphic. In this regard, a comparison with acquiring is also relevant. When paying with a card through a terminal, funds are credited to the current account within 1-3 days, depending on the payment system and the specifics of the bank's work. Payment by QR code is almost always instantaneous. Thanks to this advantage, businesses can avoid cash gaps, which are especially detrimental to small businesses.

- Why is QR payment convenient for customers?

- To pay, the customer does not need a bank card or a phone with a contactless payment function. It is enough that the customer has a banking application installed on his smartphone and a built-in camera. The phone will instantly read the QR code, and the money transfer will take place in seconds. It's faster than transferring money using an account or card number.

- What are the restrictions and limits on IBAN transfers?

- Starting from October 1, 2024, the National Bank of Ukraine has set a limit of UAH 150,000 per month for transfers between bank cards of individuals (outgoing P2P transfers / Person-To-Person transactions). Transfers to entrepreneurs to personal card accounts that are not intended for business activities also fall into this category.